Last week the Bank of England voted to keep the base rate at the all time low of 0.25%; the rate it has been since the post referendum, recession avoiding drop of 2016. The voting was 7-2 in favour of maintaining the rate, this has been pretty much the pattern for the last year yet this time there was a lot of media noise about an imminent rate rise.

While I understand the need to have something to report I wholeheartedly disagree with the predictions of a rate rise in 2017. I have consistently maintained in previous blogs (go look!) that rates are not going to rise significantly given the economic climate.

Will Interest Rates Rise?

There are one or two indicators that suggest the monetary policy committee may lean towards a rise. The first is the level of employment, some good news statistics were released last week stating that employment has never been higher in the UK and those claiming unemployment benefits has never been lower. I remember a few years ago when Mark Carney suggested that rates might go up when unemployment fell below 7% and he quickly had to change tack when unemployment fell below that level. It just was not the right time to raise rates.

The other main indicator of a potential rate rise is inflation; again traditional economic theory suggests to kerb inflation you raise interest rates. I have to say this theory has carried less weight since the credit crunch of 2008, inflation has fluctuated up and down and interest rates have been broadly the same, suggesting to me that the decision makers are taking a more pragmatic view.

So why do I think rates are not going up? Again there are likely to be many factors that the decision makers take into account however as I am not one of those people I like to take a more simplistic outlook on these things.

Firstly as a nation we are pretty highly geared, what I mean by that is that we have enjoyed borrowing money in recent years, the low interest rates have fuelled a lot of borrowing and frankly a significant rise in rates would see a lot of us struggling. Put simply if you are paying more on your mortgage each month you are going to spend less elsewhere and I don’t think the economy can’t take that kind of hit.

Uncertainty fuels doubt in the economy and I think the post Brexit uncertainty has led to a fall in the housing market. I can only speak personally here but it just feels much quieter than it did 18 months ago. If the Bank of England put rates up, even by a little bit, that is going to add fuel to that uncertainty and the housing market may suffer more as a result.

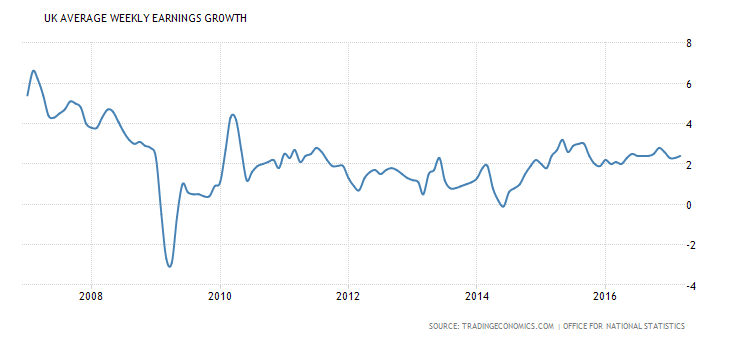

Finally the main reasoning for my argument is wages. In previous blogs I have stated that only when wage inflation starts outstripping actual inflation will the Bank of England decide to raise rates. All you need to do is listen or watch the news to see that wages are most certainly not rising in line with inflation. The 1% pay cap on public sector employees for the last few years is going to take a bit of time to catch up with inflation, even if they get their 3+% this year. The headlines last week were that wages have actually fallen in real terms meaning we all have less money in our pockets. In these circumstances I think it highly unlikely that the Monetary Policy Committee will vote in favour of a rise.

If you’re concerned about interest rates and your mortgage, please don’t hesitate to contact me for an informal chat about your circumstances and to discuss your options.