At this time last year, the financial market was predicting fairly confidently that the interest rates would be rising by the start of this year. However, the reality has been something quite different. Numerous political, economic and global events have meant that what we actually saw was the Bank of England further slashing interest rates from 0.5 per cent to 0.25 per cent in August 2016.

So where will our interest rates go next? It seems almost impossible that they could be reduced any further, what with the current rate being the lowest ebb in history. But when should we expect them to rise, and how much? Let’s investigate.

What’s happening to affect the current interest rates?

We’ve been through an eventful year or two when it comes to major changes to the UK’s economic influences, for example:

Economic concerns: In recent years, we’ve been suffering a period of negative inflation. Weak economic data coupled with concerns over a slowing global economy have led to much uncertainty over how and when things will change.

Brexit: Prior to this, the Bank of England (BOE) had been discussing forthcoming rate rises. After the vote, and predicting an economic slump, Mark Carney announced the interest rate cut and a new bout of Quantitative Easing to try and stimulate growth.

The fall of the pound: Since the Brexit vote, the value of the pound has fallen by around 20 per cent. This has caused inflation to spike, which tends to lead to an increase in interest rates, although the BOE’s predictions did not fit with this.

Trump: Donald Trump’s victory across the pond has added some uncertainty to the future of interest rates. Because he is planning to spend, spend, spend on infrastructure and building in the US, inflation over there is anticipated to rise, which could have a knock-on effect here in the UK too.

These events are undoubtedly responsible for the unexpected rate cut we experienced in mid-2016, and for the continued uncertainty over the future of our interest rates.

Predictions for the future

We’ve seen some wild predictions about the future of interest rate rises. Here are some of the most commonly encountered predictions you might come across right now:

Financial experts: The first interest rate rise will occur in late 2019, raising the rate to 0.75 per cent. Following this there will be a further 0.25 per cent increase at regular intervals, with the rate at the end of 2020 predicted to hit 1.25 per cent.

Lenders: Mortgage rates are extremeley competitive and I’ve always said that the lenders pay economists to analyse the markets who are in a much better position than I to predict but take a look at what you can get on the market for a five year fixed rate. Less than 2% is readily available with a reasonable deposit, if the lenders are happy to lend at this rate then they don’t think rates are going up significantly.

The Bank of England: BOE, at their last meeting of 2016, predicted that high inflation and slow wage growth would keep households financially squeezed into 2017. They voted to keep the rate at 0.25 per cent and, barring any major changes, are not likely to change this in the near future.

Commentators: Larry Elliott, Economics Editor for the Guardian, predicted that although rates are going up in the US, they are going nowhere in the UK. However, the Telegraph’s specialist, Roger Bootle, predicted rates would hit three per cent within three years, and five per cent eventually. I heard Roger Bootle speak at a conference late last year, he was very interesting but I can’t agree with him that rates are going to be at 3% within three years.

Howard Archer, chief UK economist at IHS Global Insight: “The Bank of England could become increasingly nervous about the inflation overshoot and feel compelled to raise interest rates – although we suspect that this would be more likely in 2018 than in 2017.”

Despite a range of opinions and predictions seen here, for the most part the outlook is very similar: Nothing will be happening in the very near future. Whether that holds to be true, only time will tell, although we can look to certain economic indicators to give us, at least a little, advanced warning.

Economic indicators for the BOE rate rise

Some key economic indicators will play an important part in whether interest rates rise, fall or stay the same. These factors include:

Inflation: In April 2015, it was at -0.1 per cent. It’s currently at 1.8 per cent and the National Institute of Economic and Social Research estimates it could get as high as 4 per cent in 2017. If the rate suddenly spikes, the BOE could be forced to raise interest rates sooner than planned. Historically raising interest rates has been a way of calming inflation so if inflation gets out of control this could lead to a rise, however in more recent times the Bank of England have not used this tool in their armoury. They appear to have preferred the waiting game.

MPC support: For years, some members of the Monetary Policy Committee (MPC) have argued for a rate rise, but since the Brexit vote, this has changed. For a while, the committee even argued for a lowering of the rate to 0 per cent, so it remains to be seen how this support will swing as 2017 plays out.

Strength of economy: The BOE lowered the base rate in 2016 in anticipation of a weakening UK economy. However, this has not happened as predicted, which strengthens the case for a rate rise, rather than any further rate cut.

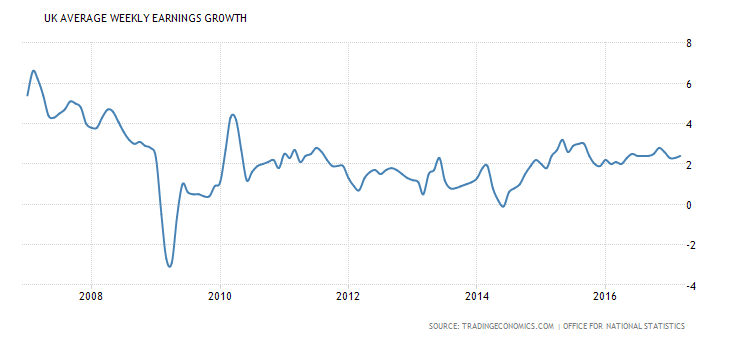

Unemployment: Unemployment is still falling. In the three months to December, the number of people out of work fell to 1.6 million, an 11-year low. Despite this, the growth of wage values has become somewhat slow, all of which could impact the timing and level of rate change.

Wage Inflation: As I’ve just noted wages have not been rising in line with inflation and this affects consumer spending. An economic tool the Bank of England to kurb spending is to raise interest rates, I just can’t see that happening whilst wages are not rising quickly. It is this indicator that I would suggest you focus on. When wages outpace inflation for a sustained period then interest rates will rise.

Predicting whether mortgage interest rates will rise or fall is a bit like consulting a crystal ball. Things happen which change even the strongest of predictions, so it’s hard to make any firm judgement on what will happen to our interest rates in the future. However, if you want an early indicator of potential rate changes, it’s a good idea to keep an eye on these indicators, as they could give an early warning of any forthcoming change.

Should you remortgage? If you would like to discuss your current mortgage arrangements and whether or not it would be sensible to remortgage and take advantage of our current low interest rates, please give me a call. 01252 759 233 or email richard@thesurreymortgagebroker.co.uk